•

Expect lower interest rates in

the second half of FY25

• Investors should add duration

with every rise in yields, as

yield upside limited.

•

Mix of 10-year maturity and 1-

2-year maturity assets are best

strategies to invest in the

current macro environment.

•

Selective Credits continue to

remain attractive from a risk

reward perspective given the

improving macro fundamentals.

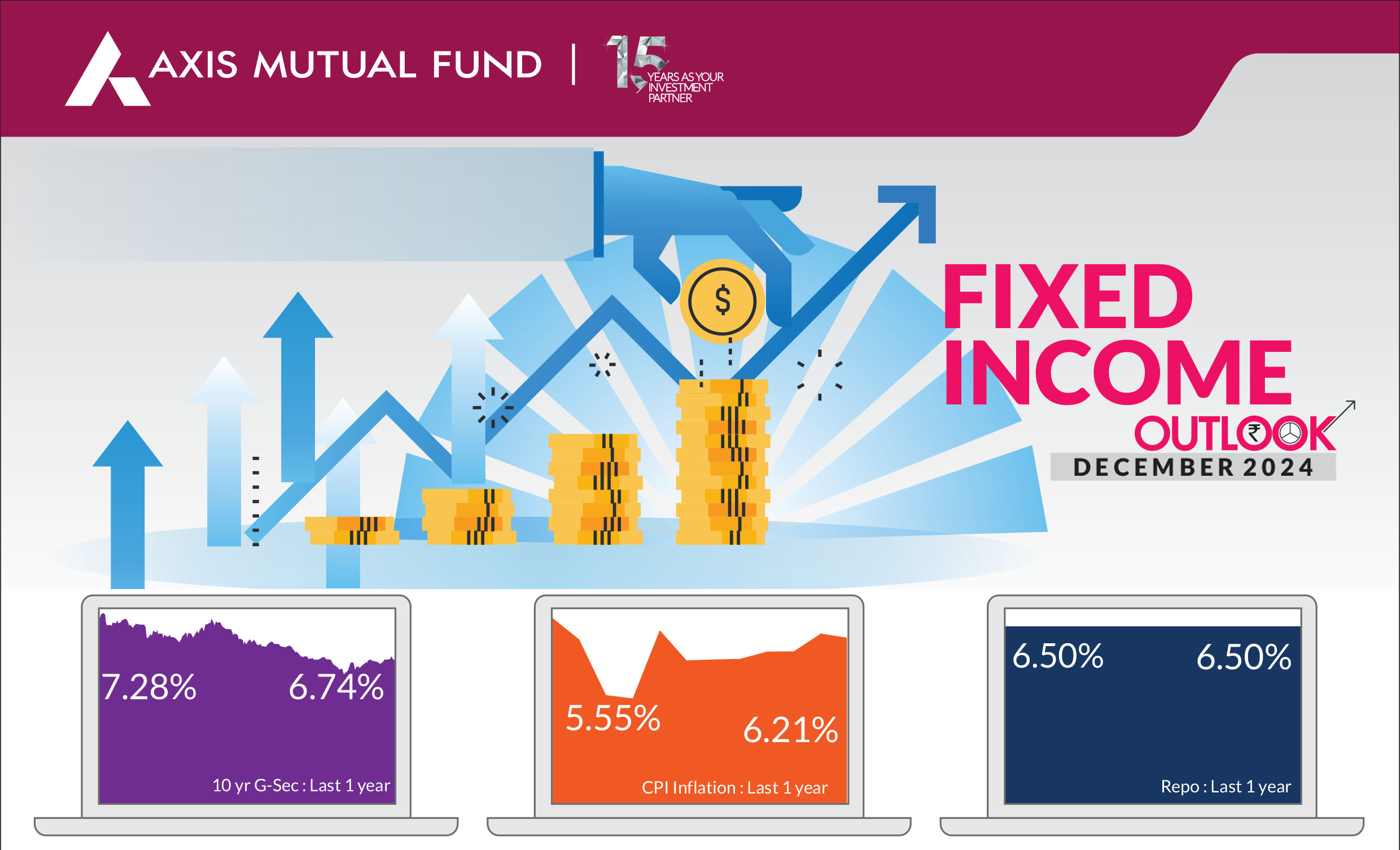

The highlight of the month was complete red sweep in US elections which has raised some important concerns in near term like (1) impact of tariffs on China and rest of world, (2) trajectory for US inflation and Fed rate cut cycle and (3) impact on EM flows, currencies and monetary policies. US yields ended lower by 15 bps, crude and dollar remained range bound as market awaits timing and actual execution of Republican policies. Bond markets yields in India have rallied by 5-10 bps across the curve in anticipation of some action by the Reserve Bank of India (RBI) due to significantly tight liquidity and unexpected GDP numbers.

►US elections, rate cuts and impact globally :

As

mentioned, the immediate concerns globally

are the impact of tariffs on the world and the

rate cuts and inflation. Fed continued with a 25

bps cut and we expect them to deliver another

25 bps in December cumulatively reducing

rates by 100 bps this year. The FOMC minutes

from the November 6-7 meeting show

optimism among Federal Reserve officials that

inflation is subsiding while the labor market

remains robust but indicated that the pace of

further interest rate cuts will be gradual.

► Inflationary pressures rise, growth moderates :

Headline inflation breached the 6% mark,

and touched 6.2% vs 5.49% in September, due to rising vegetable prices. We anticipate

headline CPI to head lower after November and expect food prices to moderate as winter

sets in. We do not foresee any changes in the full-year CPI projections.

The second quarter GDP data for FY 25 came at a shocking and disappointing figure of 5.4% due to lower capex, government spending and slowing consumption. Slowing high frequency indicators, lower Q1/ Q2 GDP and muted festive season indicates RBI might be negatively surprised on GDP forecasts and hence we expect them to revise down their GDP projections by 40-50 bps for FY25.

► RBI maintains pause but cuts CRR rates : The RBI maintained a pause on repo rate but lowered the Cash Reserve Ratio (CRR) by 50 bps to 4% in two equal tranches of 25 bps each with effect from the fortnight beginning December 14, 2024 and December 28, 2024. This reduction in CRR (the first since March 2020) will release approx. Rs 1,16,000 cr in the banking system. Additionally, the RBI has lowered the GDP growth estimate for FY25 to 6.6%, with expectations of a rebound later. Similarly, the central bank has revised its inflation target upward to 4.8%, anticipating it to decrease subsequently.

► Higher interest rates on FCNR deposits to attract foreign inflows : In order to attract more capital inflows, the RBI decided to increase the interest rate ceilings on FCNR(B) deposits. Accordingly, effective from December 6,2024 , banks can now offer rates up to the Overnight Alternative Reference Rate (ARR) + 400 basis points for deposits with maturities between 1 year and less than 3 years as against 250 bps at present. Similarly, for deposits of 3 to 5 years maturity, the ceiling has been increased to overnight ARR plus 500 bps as against 350 bps at present. This relaxation will be available till March 31, 2025 and help in attracting forex inflows.

► Banking liquidity in deficit : Banking liquidity moved into deficit due to big reduction in core liquidity on account of forex outflows. Banking liquidity is expected to be neutral to deficit for most of January to March 2025. Consequently, the operative rate may be close to or higher than the repo rate, leading to increased volatility in money market yields. This financial year, we are witnessing relatively slower credit growth. The incremental FY Credit/Deposit ratio is approximately 60%, compared to over 85% last year, while deposit growth has been robust.

The second quarter GDP data for FY 25 came at a shocking and disappointing figure of 5.4% due to lower capex, government spending and slowing consumption. Slowing high frequency indicators, lower Q1/ Q2 GDP and muted festive season indicates RBI might be negatively surprised on GDP forecasts and hence we expect them to revise down their GDP projections by 40-50 bps for FY25.

► RBI maintains pause but cuts CRR rates : The RBI maintained a pause on repo rate but lowered the Cash Reserve Ratio (CRR) by 50 bps to 4% in two equal tranches of 25 bps each with effect from the fortnight beginning December 14, 2024 and December 28, 2024. This reduction in CRR (the first since March 2020) will release approx. Rs 1,16,000 cr in the banking system. Additionally, the RBI has lowered the GDP growth estimate for FY25 to 6.6%, with expectations of a rebound later. Similarly, the central bank has revised its inflation target upward to 4.8%, anticipating it to decrease subsequently.

► Higher interest rates on FCNR deposits to attract foreign inflows : In order to attract more capital inflows, the RBI decided to increase the interest rate ceilings on FCNR(B) deposits. Accordingly, effective from December 6,2024 , banks can now offer rates up to the Overnight Alternative Reference Rate (ARR) + 400 basis points for deposits with maturities between 1 year and less than 3 years as against 250 bps at present. Similarly, for deposits of 3 to 5 years maturity, the ceiling has been increased to overnight ARR plus 500 bps as against 350 bps at present. This relaxation will be available till March 31, 2025 and help in attracting forex inflows.

► Banking liquidity in deficit : Banking liquidity moved into deficit due to big reduction in core liquidity on account of forex outflows. Banking liquidity is expected to be neutral to deficit for most of January to March 2025. Consequently, the operative rate may be close to or higher than the repo rate, leading to increased volatility in money market yields. This financial year, we are witnessing relatively slower credit growth. The incremental FY Credit/Deposit ratio is approximately 60%, compared to over 85% last year, while deposit growth has been robust.

Market view

Today's monetary policy event underscores the Reserve Bank of India's (RBI) shift towards supporting growth. The central bank's CRR cut will inject liquidity amounting to Rs 1,16,000 crore into the banking system, with an even larger multiplier effect. We had been of the view that banking liquidity would remain largely in deficit for Jan- March 2025 quarter unless RBI intervenes in form of CRR cuts and the announcement today is indicative of the RBI being mindful of the deficit in the banking system. We expect markets to rally by 8-10 bps across the curve and yields to trend lower as markets could start pricing in a 25 bps cut in February policy.We believe that from February, every policy meeting will be an opportunity for a rate cut based on the below

1) By the next policy meeting, the central bank would have clarity on inflation and growth numbers to some extent

2) The Union Budget would be rolled out and if government continues on the path of fiscal consolidation, which we believe it would, monetary easing will be the likely outcome

3) Donald Trump would be sworn in as the President of the US on January 20, 2025 and by the time of our policy meeting, all the currency movements and market reactions would be priced in

Bond and currencies despite a complete red sweep did not react much as Trump trade which is Dollar strengthening and rise in US yields was largely priced in last month. As said above earlier, we expect the Fed to lower rates in December monetary policy meeting. Weaker than expected China policy announcements also weighed on Crude and commodity prices.

Risks to view

We see currency as only risk to our long duration view. Rupee can see some depreciation which can delay the rate cuts and lower the quantum of rate cuts too.

Positioning & Strategy

We have been maintaining a higher duration across all our funds and guiding the rally in bonds since March 2024. We have already witnessed a more than 50 bps of rally in yields in 10-year bonds since the beginning of the year but positive demand-supply dynamics for government bonds and expected rate cuts will continue to keep bond markets happy, and we can expect another 25-30 bps of rally in the next 3-6 months. We believe that banking liquidity would be addressed somewhat in the Jan- March 2025 quarter due to CRR cuts. Due to favourable demand supply dynamics, we continue to have a higher bias towards government bonds in our duration funds.

Accordingly, from a strategy perspective, we have maintained an overweight duration stance within the respective scheme mandates with a higher allocation to Government bonds.

What should investors do?

• Investors should continue to hold duration across their portfolios.

• Incremental gains in long bonds would largely be post rate cuts.

• If there are no rate cuts in December policy, we can see some near term volatility or rise in yields but directionally see yields for 10 year Gsec closer to 6.5% in next 6 months.

• In line with our core macro view, we continue to advise short- to medium-term funds with tactical allocation of gilt funds to our clients.

Source: Bloomberg, Axis MF Research.